Why You Need Travel Insurance Now!

Travel insurance might seem like an unnecessary additional expense to an already expensive vacation. Many people question whether they REALLY need it. But here’s the thing about travel insurance … you never actually need it. Until you do. Here’s why you need to purchase travel insurance now …

RAWRA Travel Insurance Requirements

RAWRA insist that all our travellers purchase a valid travel insurance policy prior to departure. We will ask for your policy number prior to purchasing any airline tickets which usually occurs about ten months prior to departure. Each traveller is free to determine the insurance provider and level of cover most suitable for their needs.

What Can Go Wrong?

Natural disasters, accidents, illness, lost luggage, cancelled flights, stolen belongings … the list of possible travel mishaps is long and varied. While these are generally all rare occurrences, they can and do happen. With over 60 years of combined travel experience, Robin and Allison have seen it all. While travel insurance cannot prevent an incident, it can lessen the financial impact when the unexpected happens.

On RAWRA’s first trip to Sydney in 2017, three travellers missed their flight from to Chicago to Los Angeles, meaning they also missed their flight to Sydney. While this was devastating, RAWRA snapped into action and secured the first available flights three days later. Only one of these ladies had travel insurance. The other two were out of pocket for the hefty unexpected expense. This was a lesson learned and the turning point for RAWRA deciding that travel insurance would be mandatory for all trips going forward.

One of RAWRA’s 2024 traveller’s mother was hospitalised just days before departure meaning she was unable to make the trip. Robin quickly completed all the paperwork required for a claim and a full reimbursement was provided by the insurer. A similar thing happened on one of Robin’s 2023 trips and once again the traveller was reimbursed in full. It’s disappointing enough missing a trip without the additional sting of financial loss.

Allison has lost count of the number of overseas trips she has made, but she can recall both times she claimed on travel insurance. Once when her watch was stolen from the beach in the Greek Islands and once when she left a very expensive pair of designer prescription glasses on a ferry in Thailand. Both times the claims process was relatively simple and the funds were refunded promptly. While Allison has had multiple cancelled flights over the years, she was never out of pocket as the airlines provided accommodation, meals and re-scheduled flights. Travel insurance will only pay as a result of cancellations if the policy holder has incurred a financial loss.

While none of the experiences described above are likely to cause significant hardship, a significant medical episode overseas could cause financial ruin. The cost of an emergency medical evacuation starts at around $50,000.00. If you can’t afford that, you can’t afford NOT to have travel insurance.

Compare Policies!

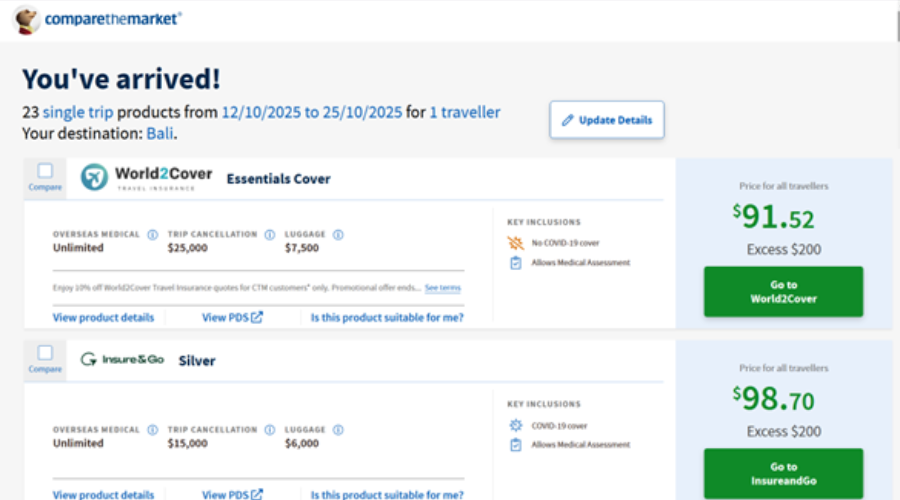

All travel insurance policies are not created equal. The level of cover can vary dramatically across providers and policies. RAWRA recommends you carefully consider the coverage provided, the cost, the excess payable, how claims are paid, the terms and conditions and any exclusions when deciding which policy is best for you. And always read the fine print! No idea where to start the search? Try a service such as Compare The Market which does some of the hard work for you.

When Should I Buy Travel Insurance?

The ideal time to purchase your travel insurance is once you have made your first payment, particularly if you have pre-existing conditions that might impact your ability to secure insurance. RAWRA will ask for proof of your cover about eleven months prior to travel which is around the time flights are booked.

Additional Cover?

Many basic travel insurance policies are exactly that. Basic. But they often provide additional coverage at a cost. Things like natural disasters, motorcycle accidents and high risk activities like sky diving are almost certainly not covered in a basic policy. Think about what you will be doing and what, if any, additional cover you need.

N.B. Motorcycle taxis (such as Go Jek and Grab) are very common in Asia. If you are considering using these services ensure you policy covers being a pillion passenger.

Making A Claim

Almost all travel insurers will require proof when making a claim. The evidence required will depend on the circumstances, but as a guide you will require

- a police report for any lost or stolen items;

- confirmation from the airline for any cancelled flights PLUS proof you are out of pocket as a result of the cancellation;

- a doctors note if you are unable to travel due to illness; and

- receipts for any medical treatment while away.

RAWRA recommends contacting your travel insurance company as soon as possible after an incident happens.

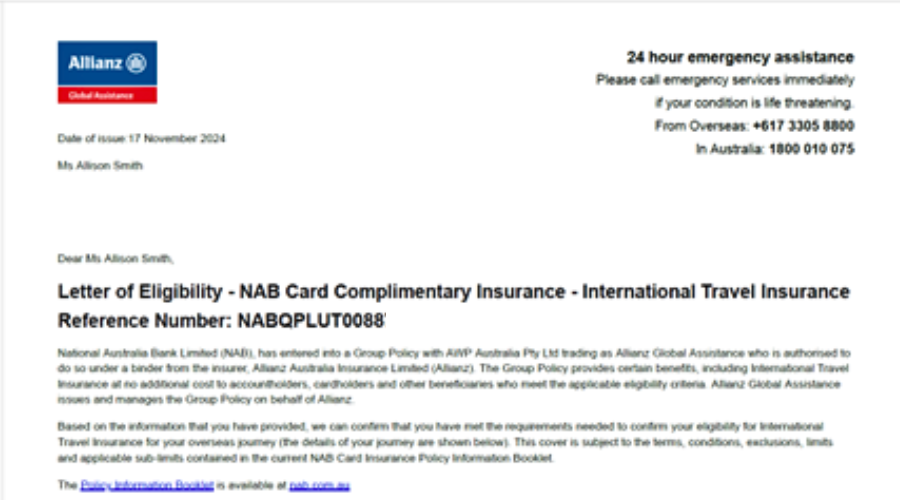

Complimentary Credit Card Travel Insurance

Some premium credit cards come with complimentary travel insurance if you pay for a portion of the trip (usually a minimum of $500) with the card prior to departure. Allison hasn’t paid for travel insurance for many years as a result of this perk. Check out if your card provides cover and you could save hundreds of dollars.

Annual Policies

If you are a frequent traveller who takes multiple trips a year, look into an annual policy. Many insurers offer a yearly policy that generally works out cheaper than buying multiple policies throughout the year.

Final Word

While the hope is that you will never need to use your insurance, take the following precautions just in case your do:

- Take a copy your policy with you;

- Leave a copy with a loved one at home; and

- Make sure know the emergency contact number.

Disclosure Statement: This post is not sponsored. The information provided is based on our own personal experiences and has not been influenced in any way by the brand(s) featured. This post contains affiliate links and any purchases will earn us a small commission at no additional cost to you.